2021 remained resilient for Fintechs even despite the continued pandemic vulnerabilities. Moreover, there was a significant growth of the venture investments in Q3 and Q4 across many regions. Verticals such as digital asset exchange, digital payments and

savings experienced 19% YoY growth according to World Economic Forum and the World Bank data.

What will 2022 look like for financial technology and the overall industry? Well, according to the

market research report by Velmie, it is expected to grow significantly in terms of investments, initiatives and establishing favorable conditions for the Fintech ecosystem.

Emerging Technology

Let's look into some cutting-edge technologies that are directly impacting the relationship between consumers and FinTechs. The greatest impact is expected from blockchain and cryptocurrencies as well as embedded finance. More than half of the respondents

plan to start implementing new technologies within a year, and 40% have already started this process.

Crypto adoption is visible across many verticals. Top banks are investing into digital assets and providing new tools to their clients, fintechs allow opening crypto wallets within their apps. International remittances as well become more and more reliant

on cryptocurrencies and blockchain. There are numerous examples, and the opportunities are infinite.

For companies seeking to onboard this new technology but don’t know quite how, our advice is to partner with a reputable

provider who will help to analyze the digital needs and design tools that are relevant to be embedded.

The Most Appealing Regions

The World Bank identifies certain conditions that create a favorable environment for the fintech industry:

-

Innovations and the pace of technology adoption (AI, security technology, mobile technologies);

-

Investment climate in the region;

-

Social and economic state including pandemic, and other social changes, that have a negative impact on traditional financial services and, as a result, lead to the emergence of fintech products.

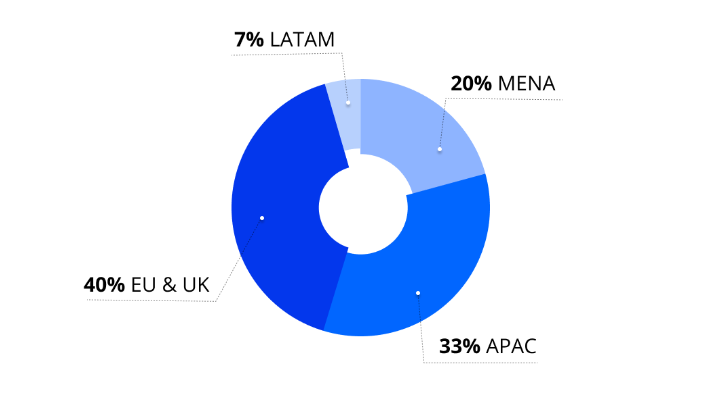

The most favorable regions to launch a Fintech startup in 2022 are Europe and the UK (40%), followed by the Asia-Pacific (33%), the Middle East and North Africa (20%). These regions offer the most fertile soil for growing a Fintech business taking into account

the conditions mentioned above.

Experience leads to success

Among various options almost a half of the interviewees chose delivering exceptional customer experience as the most important requirement to build a successful Fintech solution.

There is no doubt that creating apps that users love is a key element of a successful business. It is much more than just an impressive design. It is also about staying engaged with your clients across many channels; being able to react fast and form a community

of loyal customers. In the

Fintech industry it is even more significant as people are willing to get more financial freedom than ever before and crave for tools that would make financial services a daily thing rather than rocket science.